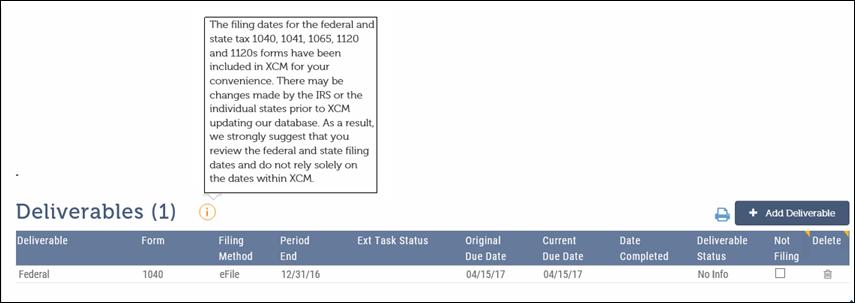

This section of the Control Sheet displays details of the Deliverables for which the Client/Entity has filed returns. For non-tax Tasks, Deliverables represent items associated with the Task, such as Financial Statements.

The Deliverables grid displays details like the Deliverable name, the form that has been filed corresponding to each Deliverable, the filing method, Period End Date, Extension Task Status, Original Due Date, and Current Due Date. You can do the following from the Deliverable section:

•Add a Deliverable

•Indicate that a Deliverable does not have to be filed (Not Filing)

•Delete a Deliverable

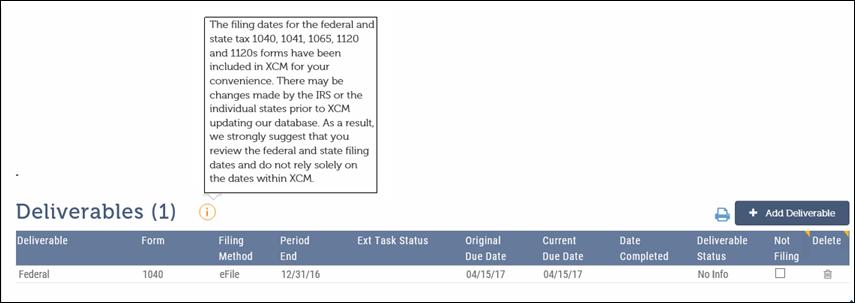

To add a Deliverable:

1. Click + Add Deliverable to open the Add Deliverable page.

2. In the Search combo box, type the name (type the first 3 letters) of the Deliverable. As you type, XCM automatically suggests the Deliverable names available. Select the Deliverable and click ADD. If the letters typed do not match any of the available Deliverable names, you will see the message “No results found”.

3. The added Deliverable appears in the Selected box at the right of the page.

4. Click SAVE to save the selected Deliverable.

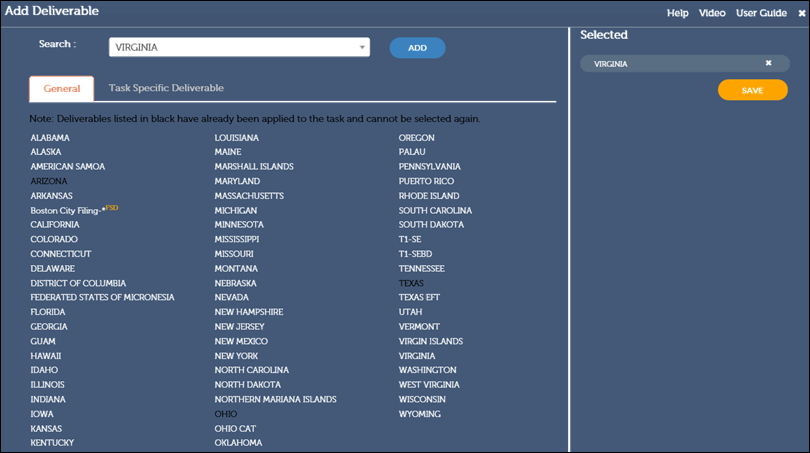

5. You can see the added Deliverable in the Deliverable grid.

|

|

Deliverable names that have been applied are marked in black. You cannot select and add them again to the Task. |

Task Information-Deliverable Added

A new Firm Specific Deliverable is created from the Utilities menu. When a firm specific Deliverable is created, the notation FSD appears beside the Deliverable name. See Add Deliverable page.

Deliverables for multiple Tasks/same Task Type

To bulk add/edit/delete Deliverables for multiple Tasks:

1. Select the Tasks from the My View page or Search Results.

2. Select the Deliverables option from the Task Information menu.

3. If the Tasks selected are of the same Task Type, then Deliverables can be added, edited or deleted in bulk across Tasks.

|

|

If the Tasks selected contain different Task types, you will not be able to add/edit/delete information in bulk. This restriction is applied because each Task Type could have different Deliverables and hence bulk operations are logically not permitted. |

Although you cannot delete Federal and General Task Deliverables, there is an alternative that gives you the ability to mark these Deliverables (and any other Deliverables) as Not Filing. This suspends the Deliverables from being used and eliminates the due dates from being reflected on the My View, Task info, and Search Results pages.

Not Filing

To mark a Deliverable as Not Filing, select the check box in the Not Filing column, see Task Information-Deliverable Added page. The Status changes to Not Filing in the Deliverable Status column and the corresponding row is grayed out in the grid. This is reflected on the Assembly, Shipping, eFile and Extension pages for the Not Filing Deliverable.

|

|

The Not Filing Status is used when you do not intend to file the Deliverable in the current year. However, it could be filed in the subsequent year. The Deliverable Status is retained when you rollover a task. |

Task Specific Deliverable

A Task Specific Deliverable helps to add and track due dates and extensions for a Task. You can create a Task Specific Deliverable within a Task.

To create a Task Specific Deliverable:

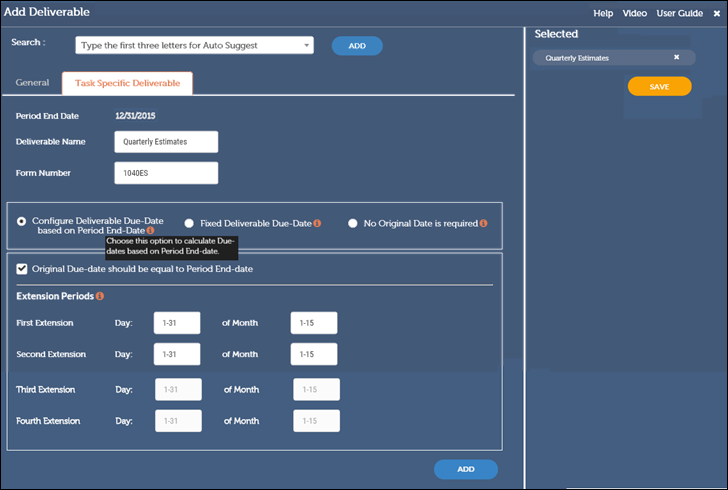

1. From the Add Deliverable page, click Task Specific Deliverable. This opens a page where you can provide details of the Deliverable you want to create.

Task Specific Deliverable: Original Due-date equal to Period End-date

2. Enter a Deliverable Name and Form Number in the respective text boxes.

|

|

If you attempt to name a Task Specific Deliverable with the same name as a Firm Specific Deliverable, you will see the error message:

|

3. Select the relevant Deliverable Due-Date depending on the Period End date. When you do this, the following options explained in the Configure Deliverable Due Date Table are displayed:

•Configure Deliverable Based on Period-End Date in the Task Specific Deliverable: Original Due-date equal to Period End-date page.

•Fixed Deliverable Due-Date in the Task Specific Deliverable: Original Due-date before or after Period End-date page.

•No Original Date is required in the Task Specific Deliverable: No Original Date is required page.

•

Configure Deliverable Due Date Table

|

Configure Deliverable Due-Date |

Description |

|

Configure Deliverable Due-Date based on Period End-date |

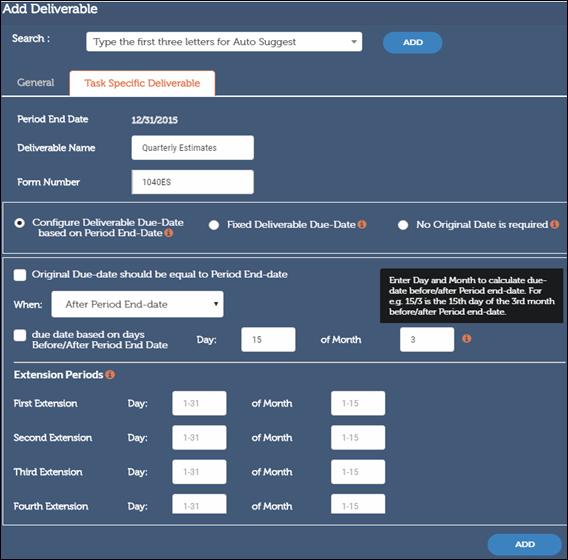

1. Select the check box if the Original Due-date is equal to Period End-date. See Task Specific Deliverable: Original Due-date equal to Period End-date page. 2. Enter the relevant Extension Periods. To select a date before or after the Period End Date: 1. From the When drop-down list, select After Period End- date or Before Period End-date. See Task Specific Deliverable: Original Due-date before or after Period End-date page. 2. Enter the numerical day and month for the due date. For example, entering Day 15 of Month 3 indicates 15th day of the 3rd month after the Period End date. |

|

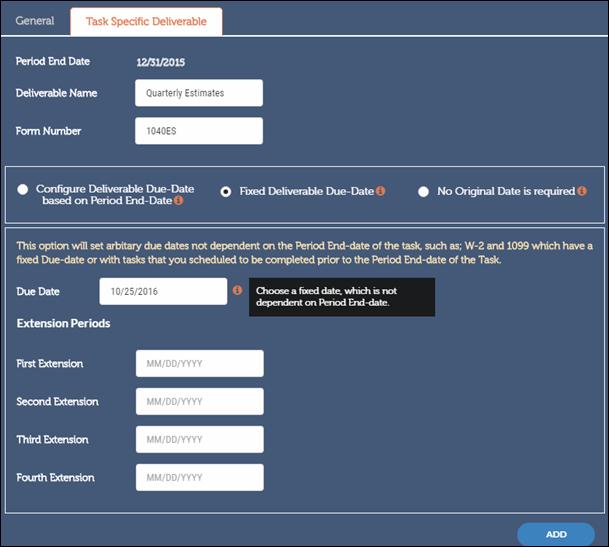

Fixed Deliverable Due-Date |

Select this option to set a required due date that is not dependent on the period end date of the Task. See Task Specific Deliverable: Fixed Deliverable Due Date page. |

|

No Original Date is required |

Select this option for those Tasks where you wish to add a deliverable that does not have a due date. See Task Specific Deliverable: No Original Date is required page. |

Task Specific Deliverable: Original Due-date before or after Period End-date

Task Specific Deliverable: Fixed Deliverable Due Date

Task Specific Deliverable: No Original Date is required

4. You can now:

•Click ADD to add another Deliverable.

•Click SAVE to save the due dates and return to the Deliverable page. The Deliverable added appears in blue text in the Deliverable column.

Delete a Deliverable

To delete a Deliverable from the grid, click the delete  icon that corresponds to that

Deliverable. This results in a soft delete and the Deliverable Status is

marked Deleted. The Deliverables that are marked Not Filing and

Deleted are grayed out in the grid. The Deliverable will be hard

deleted after the Task moves to the Completed Status.

icon that corresponds to that

Deliverable. This results in a soft delete and the Deliverable Status is

marked Deleted. The Deliverables that are marked Not Filing and

Deleted are grayed out in the grid. The Deliverable will be hard

deleted after the Task moves to the Completed Status.

It is possible to restore a deleted Task in XCM. When you want to create a rollover Task and a user has marked that specific Task for deletion by mistake, you can restore the deleted Task and create a rollover Task.

|

Deleted and Not Filing Deliverables will not be in the Tax payment calculations for the next earliest due date. Tasks with Deliverable Status Not Filing can be rolled over for the next period. |